The future of banking: four scenarios

The fact that the financial services industry, and especially banking, is going through the greatest disruption since the arrival of computers in the 60s is now universally accepted. The advent of digital technology and, more importantly, its adoption by customers is changing the fundamentals of the business. This isn’t just the arrival of a new channel – it’s a rethink of how business is conducted, how customers are engaged with, and how financial products are manufactured.

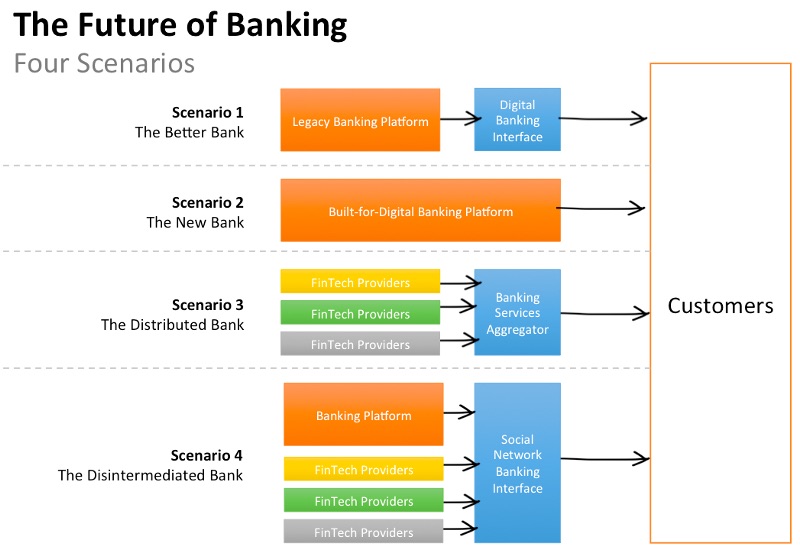

Scenario 1 — The better bank

The digital revolution has run its course and almost all customers see digital as their main engagement mode with their bank.

Scenario 2 — The new bank

The incumbents were unable to survive the digital disruption. They weren’t able to match the needs of their customers.

Scenario 3 — The distributed bank

As the fintech revolution progressed, large numbers of new businesses emerged to provide customers with better banking services.

Scenario 4 — The disintermediated bank

As customers became increasingly disenchanted with their bank, they became increasingly comfortable with going through their favourite social network or hardware provider to buy financial services.

One such disrupter is Australian startup Flash Payments.

Designed from the ground up to deliver fast, secure and very affordable foreign exchange and transfers. Flash Payments delivers extraordinary transparency and transactional control to users, setting a new level of service standard. And it does so without the hidden fees typically imposed by the banks.

With Flash Payments, users pick the date; pick the rate; send funds like an email; track transfers like a package; all without any surprise charges. There are none.

This is in stark contrast to the banks, where global payments cost more, take more time, and the routeing is opaque.

So, whether you are a business or an individual you can now skip the banks and make smart foreign exchange transfers.

Learn more about Flash Payments and sign-up and how to benefit from cutting-edge technology, great rates, transparency and control.